Creating jobs can be simple, my plan calls for the government to issue a new type of savings bond (possibly: USA BizBonds) used exclusively to finance small businesses and create jobs. The bonds would be available in different denominations at any FDIC bank or other financial institution. Each bond would yield a reasonable rate of return which would be preset for a period of 5 – 10 years.

Based on the plan, the business could borrow up to $50,000 (available as a line of credit) for each new job it would create. The interest rate paid by the business would be fixed at a rate somewhat higher than that paid by the bond holders. The loan approval process would not be based on one’s personal credit history and would not be dischargeable in bankruptcy. It is a total commitment to succeed on behalf of the borrower.

Savings bonds in the U.S. have had a long history, starting with Series A-D bonds, offered during the depression to give people an incentive to save safely. President Roosevelt used Series E bonds as a way of funding World War II. During the war years between 1941 and 1945, more than $33 billion worth were sold to the public, in face amounts as low as $25, and as high as $10,000.

The program would be administered by FDIC banks (for a built in set fee). The bottom line is the business gets the needed funding, jobs are created, the government receives additional revenue through taxes paid by the business and its employees. “It’s a win-win for the government, the business, the employees and society.” ~ Barry Michaels

Product / Service Categories

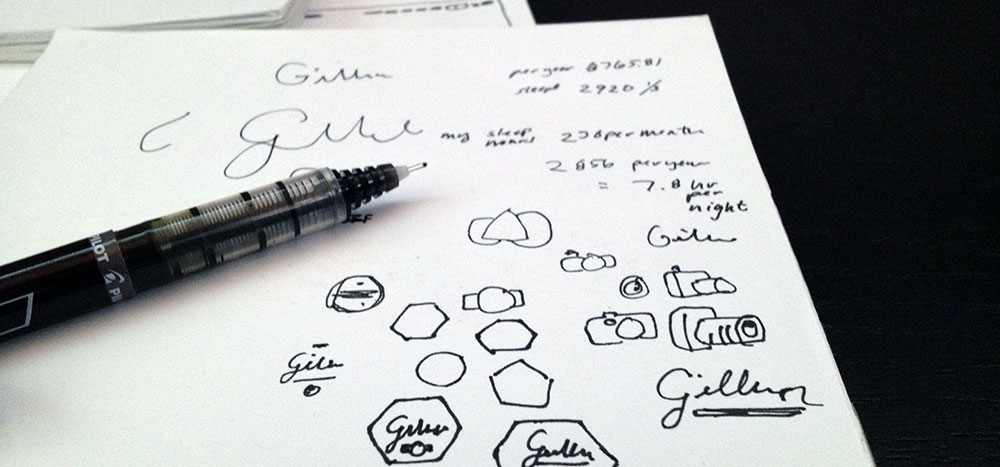

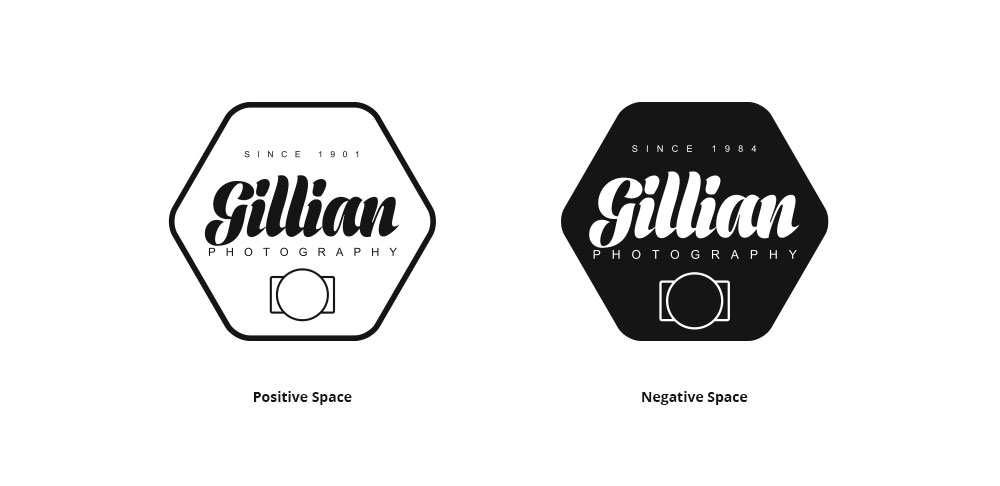

Project Name

Talk about this portfolio piece--who you did it for and why, plus what the results were (potential customers love to hear about real-world results). Discuss any unique facets of the project--was it accomplished under an impossible deadline?--and show how your business went above and beyond to make the impossible happen.